The smart Trick of Offshore Banking That Nobody is Discussing

Table of ContentsThe Only Guide for Offshore BankingAll about Offshore BankingHow Offshore Banking can Save You Time, Stress, and Money.Excitement About Offshore Banking

3%, some overseas banks can get upwards of 3-4%, though this might not sufficient factor alone to bank within the jurisdiction, it does inform you that not all financial systems were created equal. 4. Foreign Banks Have a More Secure Financial System, It is crucial to see to it your possessions are saved in a Putting your wealth in a safe, as well as much more notably, time-tested banking system is extremely important.The huge industrial banks didn't also come close. Foreign banks are much more secure choice, for one, they require greater resources gets than numerous banks in the United States as well as UK. While lots of financial institutions in the UK as well as US need approximately only 5% gets, many international banks have a much higher funding get proportion such as Belize and also Cayman Islands which carry average 20% as well as 25% specifically.

The quickest way to prevent this from happening is to establish up a global bank account in an abroad jurisdiction account that is outside the reach of the federal government. Some offshore banks, for example, do not lead out any type of money and also maintain 100% of all down payments on hand (offshore banking).

While many residential accounts restrict your capacity in holding other money religions, accounts in Hong Kong or Singapore, for instance, enable you to have upwards of a loads currencies to selected from all in simply one account. 8. International Accounts Provides You Greater Possession Security, It pays to have well-protected finances.

4 Easy Facts About Offshore Banking Shown

Without any access to your properties, just how can you safeguard on your own in court? Money as well as properties that are maintained offshore are much more difficult to confiscate because international governments do not have any territory as well as consequently can not force banks to do anything. Local courts and also federal governments that manage them just have restricted influence.

, that is not also shocking. If you are struck with a legal action you can be virtually reduced off from all your possessions prior to being brought to test.

Be certain to check your countries contracts as well as if they are a signatory for the Typical Coverage Scheme (CRS). With an overseas LLC, Limited Business or Depend on can supply a procedure of discretion that can not be discovered in any kind of personal domestic account. Banks do have a passion in keeping personal the names and details of their customers as in position like Panama where personal privacy is militantly maintained, however, Know Your Customer (KYC) rules, the CRS as well as the OECD have significantly improved financial personal privacy.

Using nominee directors can likewise be made use of to develop another layer of safety and security that eliminates your name from the documents. Though this still does not make you totally confidential it can give layers of security and also privacy that would certainly otherwise not be feasible. Takeaway, It is never as well late to establish a Plan B.

The Facts About Offshore Banking Uncovered

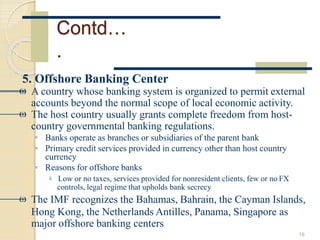

What Is Offshore? The term offshore describes a place beyond one's house nation. The term is commonly utilized in the banking as well as economic markets to define locations where laws are use this link various from the home nation. Offshore locations are generally island countries, where entities establish up corporations, investments, as well as down payments.

Enhanced stress is leading to more coverage of foreign accounts this page to international tax obligation authorities. In order to qualify as offshore, the activity taking location must be based in a nation other than the firm or financier's house nation.

Offshoring isn't usually prohibited. Hiding it is. Unique Considerations Offshoring is perfectly legal due to the fact that it supplies entities with an excellent deal of personal privacy as well as discretion. Authorities are concerned that OFCs are being utilized to stay clear of paying taxes. There is boosted stress on these countries to report international holdings to global tax obligation authorities.

What Does Offshore Banking Do?

Companies with significant sales overseas, such as Apple and also Microsoft, may take the chance to maintain associated earnings in offshore accounts in nations with lower tax problems. This technique is primarily made use of by high-net-worth investors, as running offshore accounts can be specifically high.

Offshore territories, such as the Bahamas, Bermuda, Cayman Islands, and the Island of Man, are preferred and understood to provide rather protected financial investment opportunities. Benefits as well as Downsides of Offshore Investing While we have actually listed some normally approved benefits and drawbacks of going offshore, this area takes a look at the advantages and disadvantages of overseas investing.

This means you could be responsible if you don't report your holdings. You ought to do your due persistance if you're mosting likely to spend abroadthe same way you would certainly if you're collaborating with a person in your home. Ensure you like this select a trusted broker or financial investment professional to guarantee that your money is managed effectively.